With great pleasure, we will explore the intriguing topic related to North Carolina Income Tax Rate 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

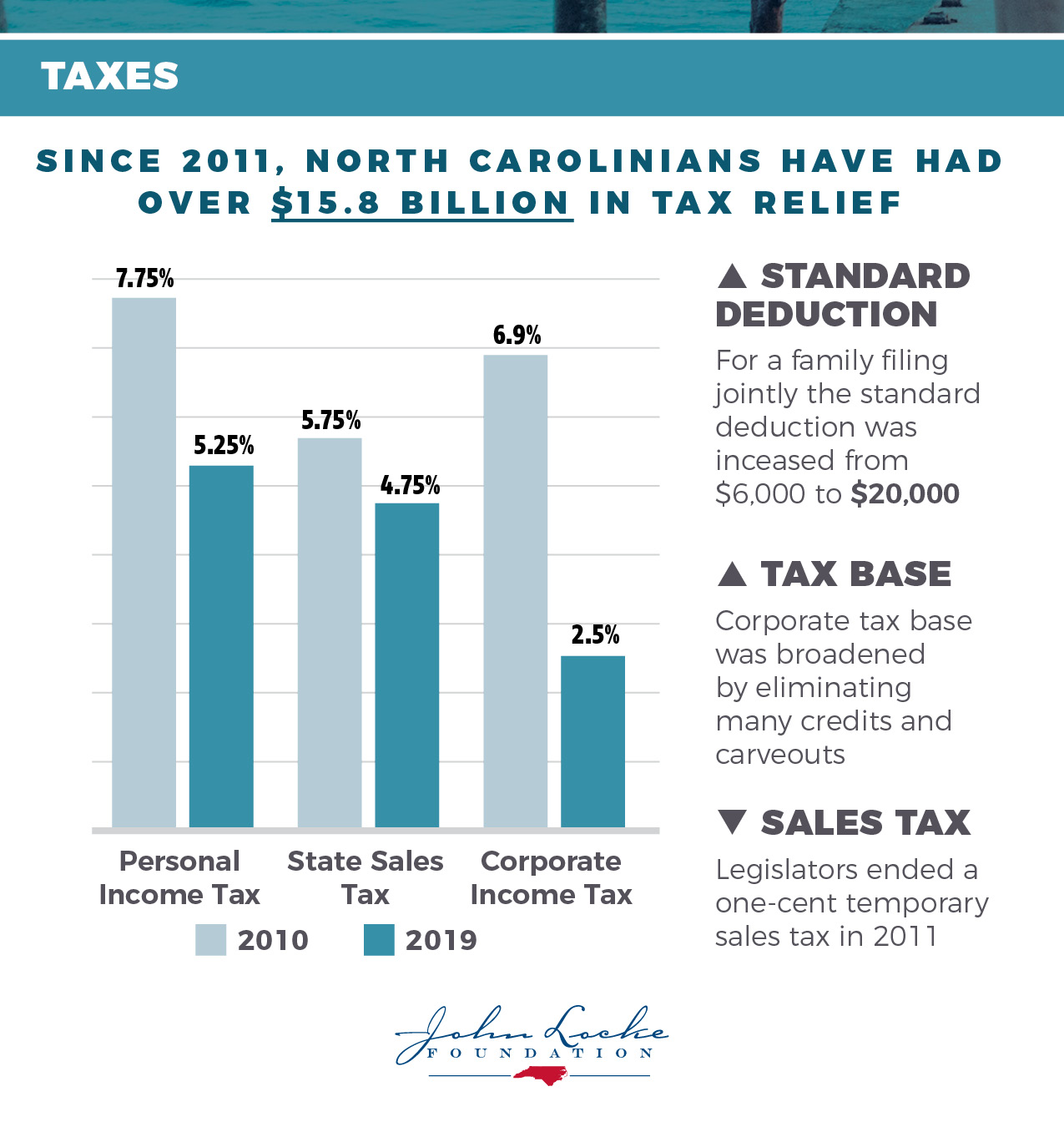

The state of North Carolina levies an income tax on its residents and non-residents who earn income within the state. The tax is calculated based on a progressive rate structure, meaning that the higher your income, the higher the percentage of your income that you will pay in taxes.

You are required to file a North Carolina income tax return if you meet any of the following criteria:

The due date for filing your North Carolina income tax return is April 15th. However, you can file an extension to October 15th if you need more time.

If you fail to file your North Carolina income tax return or pay your taxes on time, you may be subject to penalties and interest.

If you expect to owe more than $1,000 in North Carolina income tax, you are required to make estimated tax payments throughout the year.

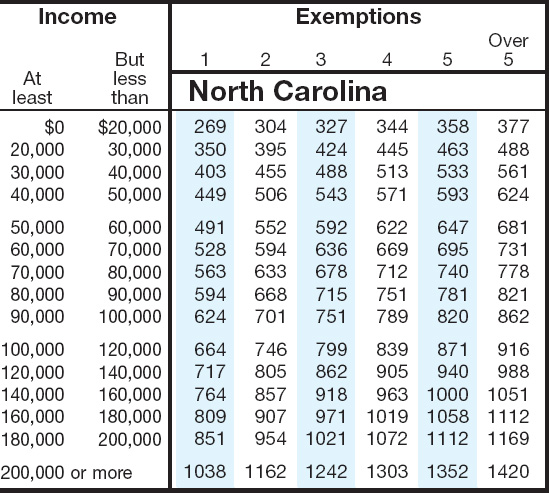

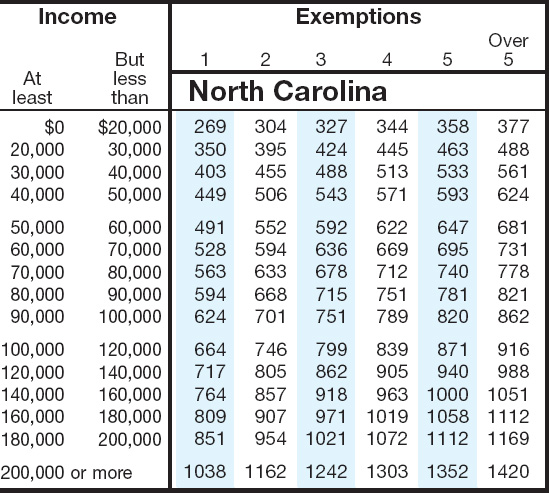

Your employer will withhold North Carolina income tax from your paycheck based on the information you provide on your W-4 form.

For more information about North Carolina income tax, please visit the North Carolina Department of Revenue website at https://www.ncdor.gov/.

The information provided in this article is for general informational purposes only and should not be construed as professional tax advice. Please consult with a qualified tax professional for specific advice on your individual situation.

Thus, we hope this article has provided valuable insights into North Carolina Income Tax Rate 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!